Financial Lessons from the Great Depression

Looking Back to Move Forward

The Great Depression remains one of the most challenging times in modern economic history. Families faced unemployment, businesses closed, and entire communities struggled to survive. Yet within the hardship came valuable lessons that continue to shape how we think about money and stability today. These lessons are not just about governments and policies—they also apply to personal financial habits. For example, many individuals today seek credit card debt relief when economic stress builds, echoing the idea that proactive action is better than waiting for problems to spiral. Looking back at the Great Depression gives us timeless insights into financial resilience.

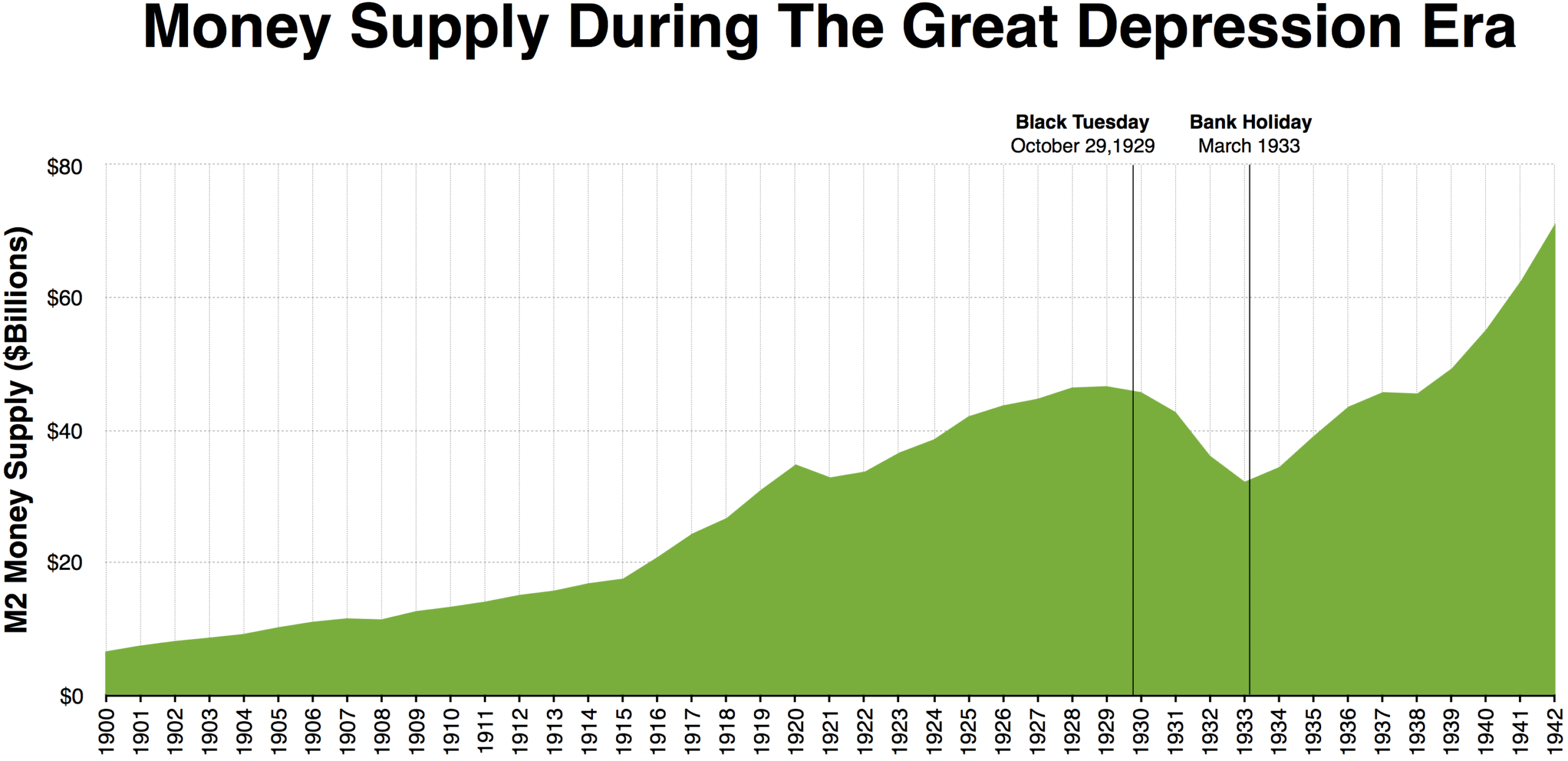

Graph depicting money supply during the Great Depression. Image source: Wikimedia Commons

The Role of Policy in Stability

One of the clearest lessons from the Great Depression is the importance of coordinated policy. At the time, delays and disagreements between fiscal and monetary authorities worsened the downturn. It was only when governments took bold actions—such as creating new job programs, insuring banks, and adjusting interest rates—that recovery slowly began. Today, we see echoes of those decisions whenever central banks cut rates during a slowdown or when stimulus checks are sent out during crises. The lesson is simple: strong policy, taken quickly, can prevent economic pain from spreading deeper.

Trust in the Financial System

During the Great Depression, people lost faith in banks as thousands of them failed. Without trust, even healthy institutions collapsed because people rushed to withdraw their money. This highlighted the need for stronger protections. The creation of deposit insurance programs restored confidence and kept people from fearing that every downturn would wipe out their savings. For individuals today, the lesson is clear: stability in the financial system protects everyone. It also shows why personal trust in where you put your money matters, whether that is in a local credit union, a major bank, or digital platforms that promise safety.

Discipline in Personal Habits

Beyond national policies, the Great Depression reshaped how people thought about personal money management. Families learned to stretch resources, avoid unnecessary debt, and build savings whenever possible. That mindset of discipline became a cultural hallmark of the generation that lived through it. While today’s economy looks very different, the principle still applies. Avoiding overspending, creating an emergency fund, and paying attention to long term goals are habits that protect households against sudden downturns.

The Value of Diversification

Another takeaway from the era is the danger of relying too heavily on a single source of income or investment. Many families and businesses at the time were deeply tied to one sector, such as farming or manufacturing. When that sector collapsed, their livelihoods vanished. The same lesson applies today: diversifying income streams and spreading out investments reduces risk. Having multiple sources of security provides a safety net when one area takes a hit.

The Power of Community Support

While financial lessons often focus on numbers, one of the most overlooked lessons from the Great Depression is the importance of community. Neighbors shared food, families pooled resources, and local groups organized to help those most in need. Economic resilience is not just about what you save, but also about the support systems you build around you. In tough times, having strong connections can mean the difference between struggling alone and weathering the storm with help.

Why History Still Matters

It is easy to think of the Great Depression as distant history, but the financial lessons remain relevant. From government responses to individual financial discipline, the lessons are timeless reminders of what works and what does not. Economic downturns may look different today, but the underlying challenges of stability, trust, and resilience are the same. By studying past struggles, we are better prepared for future shocks.

Applying the Lessons Today

So how can these lessons guide us now? Start by creating disciplined financial habits: save regularly, reduce unnecessary debt, and plan for emergencies. Support systems also matter, so nurture community connections and share resources where possible. At the same time, advocate for responsible policies that ensure financial stability at the national level. These combined approaches—both personal and collective—are what create true resilience.

Final Thought

The Great Depression was a time of immense hardship, but it left behind wisdom that continues to shape financial decision making today. It showed the need for strong policy, trust in financial systems, personal discipline, and the value of community. These lessons remind us that resilience is built not through perfection, but through preparation and balance. Whether you are managing your household budget or watching how governments respond to crises, the lessons of the past can guide us toward a more stable financial future.